Google pay is the fastest and most straightforward way to send money from wherever you are to anyone. You can use it anywhere, like in stores, for online payments, in apps, or on the Google Play store.

In this article, we will see whether or not there are any Google Pay transaction charges. With so many wallets out there, we are continually looking for how to send money without incurring any additional charges.

While most of the transactions can be made free of cost on Google pay, there are some hidden charges when you exceed a specific limit of transactions over one month. These charges are usually levied by your bank and not by the Google pay app itself. Keep reading this article on Google Pay transaction charges to find out more!

Google Pay Transaction Charges – All you Need to Know

Before we jump into the details of the charges levied when you make a transaction via the Google Pay app, let’s try and understand a bit more about how the Google Pay application works.

We all know that Google pay is a wallet, much similar to your physical money wallet, which aids in making online transactions. It is an extension of your bank account, where you can make payments from and receive payments directly to your bank account.

Google Pay entirely works on UPI ( Unified Payment Interface )based transactions, a real-time payment system developed by the National Payments Corporation of India that facilitates inter-bank transactions.

Now that we know on a very high level how Google Pay works, let’s look into what are the Google Pay transaction charges!

How much are the Google Pay Transaction Charges?

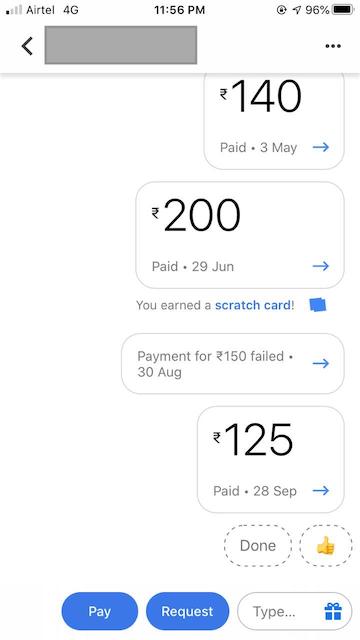

Google pay does not charge any fee as of now for the transactions you make via the app. However, in their policy form, they mention that there could be a fee levied on a specific type of transaction. The policy says two scenarios where a possible transaction fee could be charged, these include:

- Third-party Provider fee: Third-party providers are bank providers of the account you have added to your Google pay Account. Most of the bank changes for UPI transactions when the transactions per month exceed a specific limit. Since Google Pay uses the UPI mode of transactions, you will have to pay a certain fee after the limit of transactions exceed.

- Google Fees: These could be the fee that is applied to the use of Google Pay services. It could be applied to a certain kind of transaction. No fee is levied when you send and receive money to/from family/friends. You will be notified

How much is a Third-party Provider fee on Google Pay?

The bank account you have added to Google Pay could charge you a fee after a certain amount of transactions has been exceeded. This fee is charged by the bank and not by Google Pay.

The fee charged depends on the bank you have an account with.

The top reputed banks such as ICICI Bank, Kotak Mahindra Bank, and Axis Bank charge a fee of Rs 2.50 for an amount up to 1,000 and Rs 5 for an amount above 1,000 after a total of 20 transactions. So, on the 21st transaction using google pay, you will have to pay a transaction fee of either Rs 2.50 or Rs 5, depending on the amount that you transfer. The first 20 transactions are free of cost.

Note: The 20 transactions include all UPI transactions that you make, not just the ones made on Google Play. If you have made, say 7 UPI transactions in another app, then after 13 transactions on Google Pay, you will be charged the respective fee.

This kind of fee is applied by most banks across the country. The fee charged could vary anywhere between Rs 1 – Rs 10, or could even be more. It differs from bank to bank.

If you have been charged an extra amount more than the fee mentioned, you can contact the respective bank for a refund. In case an amount more than the amount you intend to send has been transferred, contact Google Pay Support to help you out.